What is probate and why should I try to avoid it?

Probate is a legal process that confirms a will and divides assets after someone dies. It's slow, costly, and public. It can hold up your assets for a long time, add to legal bills, and reveal your family's financial details to everyone.

How can a revocable living trust help me avoid probate?

A revocable living trust lets you move assets to the trust while keeping control. When you die, your assets go to your beneficiaries without probate. This saves time, and money, and keeps your family's affairs private.

What are some other strategies for avoiding probate?

To avoid probate, you can use transfer-on-death designations, joint ownership, and payable-on-death accounts. You can also name beneficiaries on financial accounts and insurance policies.

Do I really need an estate planning attorney?

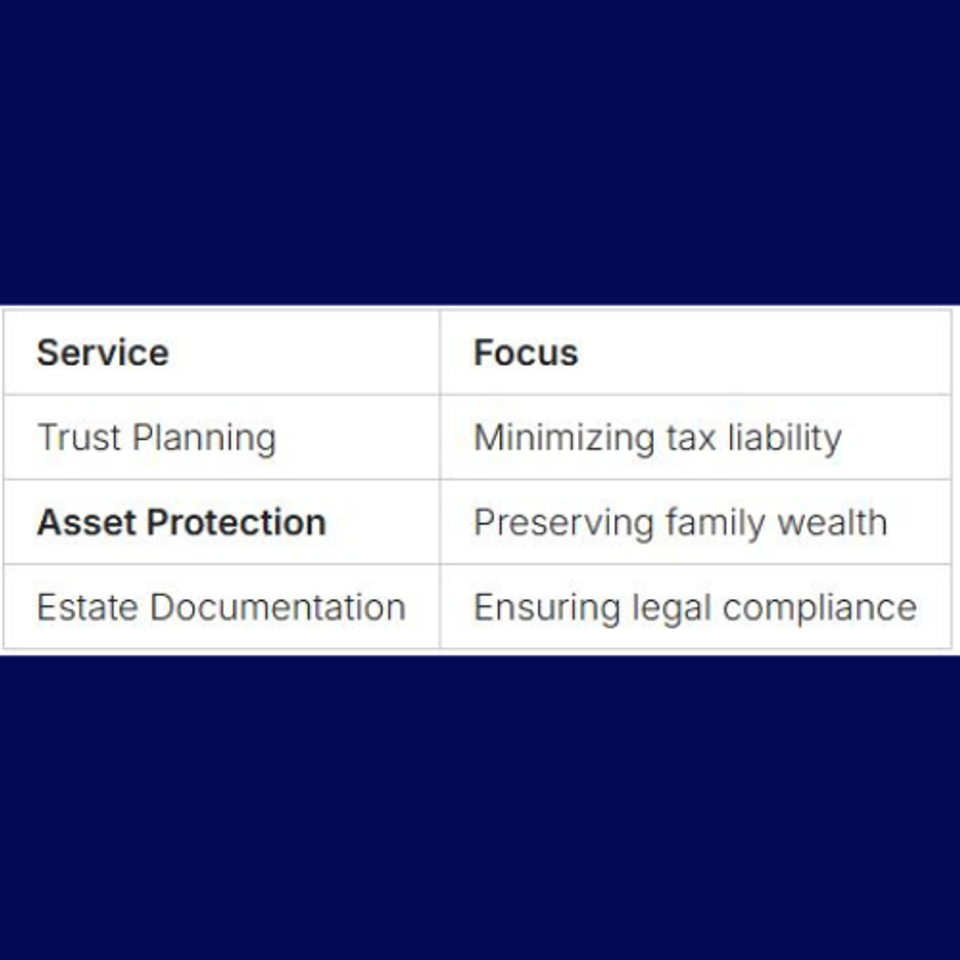

While you can make some estate plans yourself, an attorney offers vital guidance. They help with legal details and taxes, and ensure your assets are handled as you wish.

How often should I update my estate plan?

Update your estate plan every 3-5 years or after big life changes. This keeps your plan current and protects your family's interests.

What's the difference between a will and a living trust?

A will outlines asset distribution after death and goes through probate. A living trust moves assets to the trust during your life, avoiding probate. It offers more privacy and flexibility.

Can I protect my assets from potential future legal claims?

Yes, tools like irrevocable trusts and smart asset management can shield your assets. An estate planning attorney can craft a strategy to protect your assets while keeping financial flexibility.

How much does estate planning typically cost?

Costs vary based on your estate's complexity and needed services. Estate planning saves your family money on probate, legal fees, and taxes in the long run.

What happens if I die without an estate plan?

Without a plan, your assets follow state laws, not your wishes. This can cause family disputes, longer probate, and higher costs for your heirs.

How long does the probate process typically take?

Probate can last months to years, based on estate complexity, family disputes, and court schedules.

Living trusts can greatly shorten this time for your loved ones.